No products in the cart.

It is sometime suggested that home ownership is now only a dream for many people, but Census data shows the rate of home ownership has been increasing since the 2018 Census. In 2023 66 percent of households owned their own home (including those held in a family trust), while 34 percent of households did not own their home. That compares with 64.5 percent of households owning their own home and 35.5 percent of households that did not own their home in 2018.

Over the past 40 years house prices have increased faster than the rate of increase in incomes, but lower mortgage interest rates have helped more people to enter the housing market. Debt-to-income ratios introduced by the Reserve Bank in late 2024 are expected to limit future house price growth.

The introduction of Kiwisaver in 2007 has helped households save enough money to make a reasonable deposit on home and is an important contributor to the increase occurring in home ownership rates among young people.

Government measures to support home ownership are:

1. First Home Loan for buyers with a low deposit. Most home loan lenders require a minimum 20% deposit. With a First Home Loan, you only need a 5% deposit. Kāinga Ora underwrite the loan, this means that bank or lender can accept a 5% deposit when they usually would not be able to. The loans are available to people under a specified income level.

2. Kāinga Whenua Loan for Māori to buy or build on Māori land. The Kāinga Whenua Loan is an opportunity for Māori to build, purchase or relocate a house on Māori land that has shared ownership. The loans are also available for Māori collectives, including land trusts.

3. Tenant home ownership grant for Kāinga Ora tenants. If you’re currently a Kāinga Ora tenant, you may be eligible for a grant to go towards buying the home you’re living in. The tenant home ownership grant is a gift of 10% of the purchase price of selected Kāinga Ora houses up to a maximum of $20,000. Houses in some areas are not available for tenant home ownership.

4. Access to Kiwisaver for people who have previously owned a house. If you have previously owned a house but no longer own a house it may be possible to access your Kiwisaver account. This applies to people who didn’t use Kiwisaver to purchase their previous house. There are other conditions as well.

5. Some low-income households are also able to use the Accommodation Supplement to assist with mortgage payments. You don’t need to be receiving a benefit from the government to apply for the Accommodation Supplement.

It is hard to find any accurate statistics on the degree to which parents are helping their children into home ownership.

The main options for helping children into home ownership are:

This is a worthwhile option, even if the children have been able to save the 20 percent deposit required.

A few years ago I did the sums for a couple who were buying their first home using a Crown mortgage calculator. We assumed the couple continued with the same weekly payments on their mortgage after receiving a gift to reduce the balance on their mortgage. A $10,000 gift saved the couple $40,000 in interest over the 30-year term of the loan, shortening the time to pay it off. Small gifts to help them top up payments on the mortgage will also have long-term benefits if you don’t have a big amount to gift. Some people are concerned that the amount they can gift is limited but the key limit applies during the period before you need to access residential care for yourself or your spouse. It is best to complete your major gifting well before then.

This will have the biggest financial impact if it is used to help them pay off their loan faster. It is important to have a loan document, even for a loan to your children, and to seek legal advice.

This has a similar benefit to an interest free loan but offers much greater flexibility. As parents, you keep full control over your money.

BNZ and Kiwibank New Zealand offer offset mortgages which allow parents to use their own savings to offset the interest on their children’s mortgages.

There are some benefits over the interest free loan option:

-

- The money you make available to be linked to the offset loan remains in your control and you can use it at any time. That means it is possible to link your savings and the money in your day-to-day spending account to be offset against the mortgage. It would not be practical to commit the same level of support through an interest free loan

- The offset mortgage option has no establishment cost for you, while a large interest free loan is best provided through a secured mortgage, which involves legal fees. Moving your savings to the same bank as your child is easy.

- Your child is not in debt to you. Being in debt to someone else does influence the relationship between the lender and borrower. With the offset mortgage, the bank sets the repayment terms and monitors that payments are being made, so you don’t need to worry about that.

Any savings accounts linked to an offset mortgage do not receive any interest payments. Banks currently charge a higher interest rate for offset mortgages. That means the weekly payments are higher than for a low interest fixed-term mortgage. However, if the interest on the mortgage is being offset, this speeds up the repayment of the mortgage, since more principal is paid off each week.

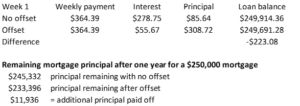

So how does the offset mortgage work? If your child has taken out a mortgage for $250,000 and you have a combined amount of $200,000 in your day-to-day spending and savings accounts, the bank charges interest on only $50,000. The following example is based on a 25-year mortgage for $250,000, which has an interest rate of 5.8%.

In the first week of the mortgage, the offset means $223.08 less is paid in interest and $223.08 more principal is paid off compared with the normal principal repayments.

Most parents will not have that much in savings, but even a much smaller amount can make a big difference on how long it takes to pay the mortgage off. If you have only a small amount that you can offset, most of the mortgage can be put into a lower interest fixed-term mortgage and a smaller balance kept on the offset loan.

An offset mortgage also allows your child to have money in a savings account for large one-off expenses, but the balance in their spending and savings accounts is also offset against the mortgage.

Other articles which might be helpful are:

Financially helping your adult children

Please login to comment.